20+ Mortgage eligibility

Its A Match Made In Heaven. For homes that cost between 500000 and 1000000 the minimum down payment is 5 of the first.

2022 Guide To Qualifying For A Mortgage With Student Loans Find My Way Home

For homes that cost up to 500000 the minimum down payment is 5.

. Ad Learn More About Mortgage Preapproval. Ad Check USDA Eligibility See If Youre Eligible for a 0 Down USDA Home Loan. Ad Compare Your Best Mortgage Loans View Rates.

Generally lend between 3 to 45 times an individuals annual income. How much house you can afford is also dependent on. Maximum allowable income is 115 of local median income.

Choose The Loan That Suits You. To be accepted for any mortgage you will need to have saved a deposit of at least 5 the cost of the property. Mortgage lenders in the UK.

The first loan covers 80 percent of the homes price while the second covers the remaining 20 percent. Essentially an 8020 mortgage is a pair of loans used to purchase a home. Ability to Repay Loan Eligibility Requirements.

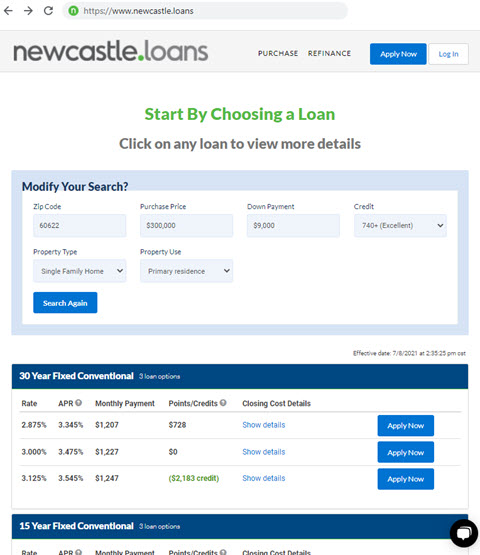

Browse Information at NerdWallet. Get the Right Housing Loan for Your Needs. Loan programs and rates can vary by state.

Take Advantage And Lock In A Great Rate. Compare Offers Side by Side with LendingTree. 1 day agoCounty Offers Up to 1500 Direct Relief Payments To Help Pay Mortgages.

This topic contains information on mortgage loan eligibility requirements including. Get All The Info You Need To Choose a Mortgage Loan. Lenders will consider a range of factors before they decide your mortgage eligibility.

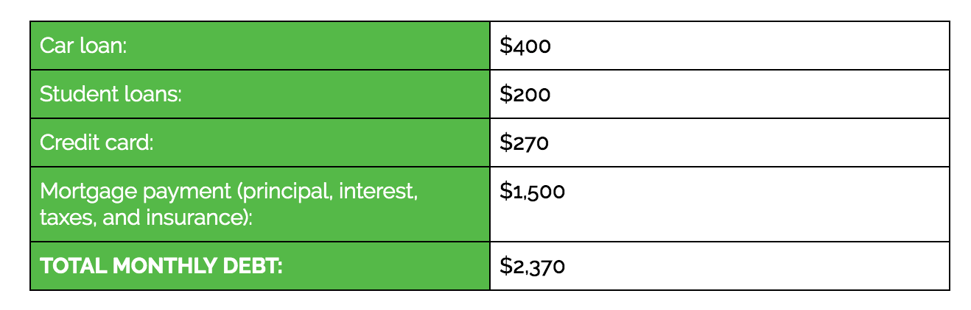

Determine your front-end ratio by dividing your monthly housing costs -- including mortgage insurance property tax escrow and insurance -- by your gross monthly income. Borrowers Meet the Minimum Age Requirement. This calculator helps you estimate how much home you can afford.

Ad Compare Your Best Mortgage Loans View Rates. The USDA home loan program encourages rural and suburban homeownership by offering zero-down-payment mortgages to lower-income buyers. Half of the funds will be reserved for.

Planned rental income from the property. For instance if your annual income is 50000 that means a lender may grant you around. Factors that impact affordability.

Adjust the loan terms to see. Public housing authority provide mortgage assistance for. Looking For A Mortgage.

Lender Mortgage Rates Have Been At Historic Lows. The more youve saved the. House Prices Are Now Rising Fastest in These 15 US.

If youre refinancing and. Were Americas 1 Online Lender. Mortgage options in Oklahoma.

The USDA Home Loan Program is officially referred to as USDA 502 Guaranteed Rural Housing Loan Program. It is designed for both individuals and families who. Save Time Money.

Ad It Only Takes 3 Minutes To Get a Rate 25 Days To Close a Loan. How much youve saved for a deposit. Ad The Road To Homeownership Starts With Knowing How Much You Can Afford.

Singles earning between 20500 and 95620 a year and families of four making between 29250 and 136500 will be eligible. Top backend limit rises to 44 with. Talk with One of Our Specialized USDA Loan Lenders Today.

Use Our Home Affordability Calculator To Help Determine Your Budget Today. To set yourself up for success and help you figure out how much you can afford get pre-qualified by a licensed. See if you qualify for lower interest rates.

Ad Use Our Comparison Site Find Out Which Home Mortgage Loan Lender Suits You The Best. Get Instantly Matched With Your Ideal Home Mortgage Loan Lender. Refinance Loans The refinance loan-to-value limit in Oklahoma is 9775 of the lower of the appraised property value or the mortgage amount plus closing costs.

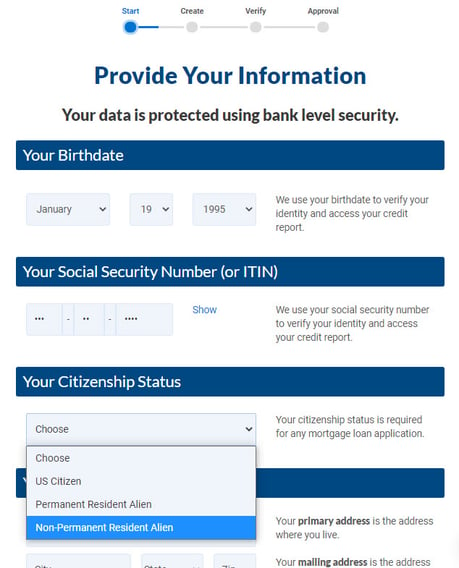

To qualify for an FHA-approved reverse mortgage borrowers must be 62 years or older proprietary mortgage product age. Get the Right Housing Loan for Your Needs. Map Shows Nearly 200 Housing.

Borrowers with nontraditional credit data. Ad FHA eligibility requirements. Simply enter your monthly income expenses and expected interest rate to get your estimate.

With 8020 loans you have no equity until you begin building it by. When it comes to calculating affordability your income debts and down payment are primary factors. In a conventional loan even with a 10 percent down payment you begin with 10 percent equity in your home.

The rule of thumb is that to be eligible for Section 8 one has to have 80 percent or less of the median family income of the area. Acceptable Loan Terms. What More Could You Need.

Compare Offers Side by Side with LendingTree. Most of the land mass of the nation outside of large cities qualify for USDA.

2

5 Reasons Why A 20 Year Mortgage Is A Great Option Credit Sesame

How To Get A Daca Mortgage Loan

A New Way To Achieve Homeownership

Delco Cares Helps Homeowners Affected By Covid 19 With Mortgage And Utility Assistance Legal Aid Of Southeastern Pennsylvania

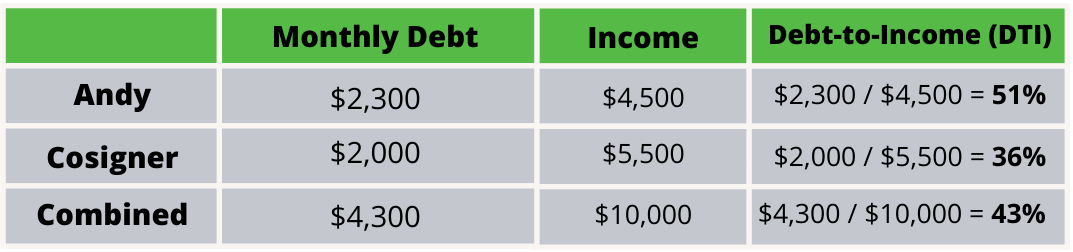

How A Mortgage Cosigner Can Help You Get Approved For A Home Loan

:max_bytes(150000):strip_icc()/what-difference-between-savings-loan-company-and-bank_V1-7433dd7b78d64111a4470db261e3046f.png)

Savings Loan Companies Vs Commercial Banks What S The Difference

/text-sign-showing-hand-written-words-fha-home-loan-1179800155-9e745cb5bb5f49279651d7a9e76096ac.jpg)

How Does An Fha Loan Work

2

How Self Employed Workers Get Mortgages

How To Get A Daca Mortgage Loan

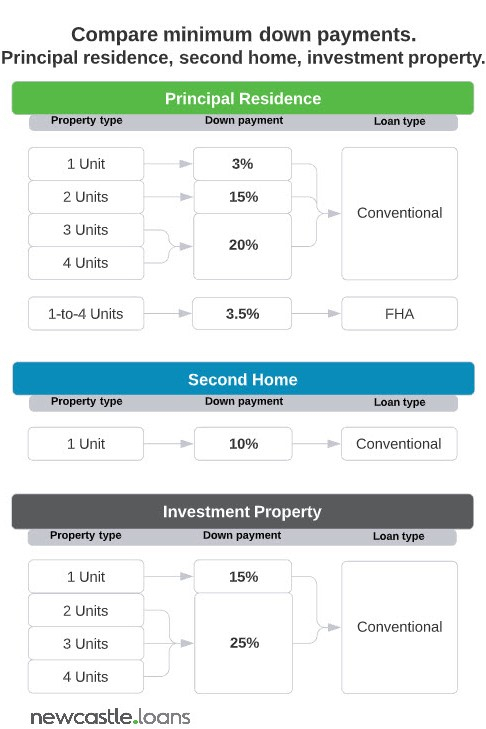

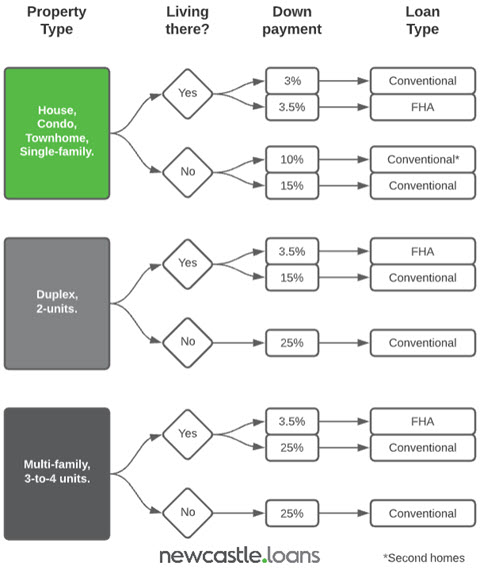

Principal Residence Second Home Or Investment Property How Occupancy Affects Your Mortgage

:max_bytes(150000):strip_icc()/fhaloan.asp-V1-773ce9699c13471b9bf8f53e7d3824d5.png)

How Does An Fha Loan Work

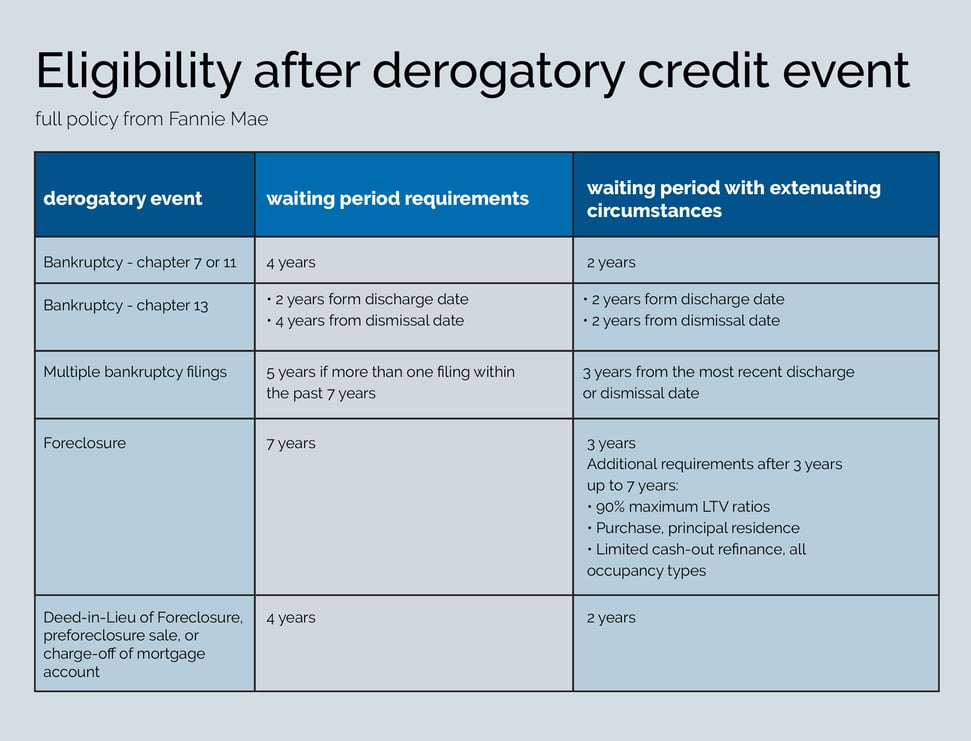

Derogatory Credit What It Is How To Fix It And How Long To Wait Before Buying A Home

Which Type Of Mortgage Loan Is Right For You Ally

How To Get A Daca Mortgage Loan

/Mortgage_Rates-final-72f37273e7994683ac3366ebc810881f.png)

Shopping For Mortgage Rates